|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Ways to Refinance Your Home: Essential Tips and StrategiesRefinancing your home can be an excellent way to reduce your mortgage payments or access home equity. However, it's crucial to understand the process and avoid common pitfalls. This guide will walk you through various refinancing methods and provide valuable insights. Understanding Home RefinancingHome refinancing involves replacing your existing mortgage with a new one, often with better terms. Here are some popular refinancing options:

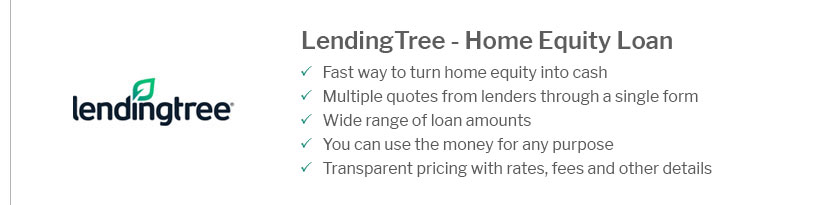

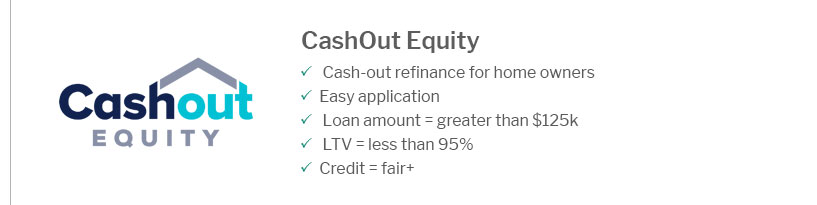

Benefits of RefinancingLower Interest RatesOne of the primary reasons to refinance is to secure a lower interest rate. This can lead to significant savings over the life of the loan. Check the current home refinance interest rates to assess your potential savings. Shorten Loan TermBy switching to a shorter loan term, such as a 15-year fixed mortgage, you can pay off your home faster and reduce overall interest costs. Explore 15 year fixed refinance options for more details. Access Home EquityCash-out refinancing enables you to tap into your home's equity for various financial needs, such as home improvements or debt consolidation. Common Mistakes to Avoid

FAQ SectionWhat is the best time to refinance my home?The best time to refinance is when you can secure a lower interest rate than your current mortgage or when your financial situation has improved. Monitoring the market for favorable rates is essential. How does refinancing affect my credit score?Refinancing can temporarily lower your credit score due to hard inquiries and changes in credit utilization. However, consistent on-time payments can help improve your score over time. Can I refinance with bad credit?Yes, it is possible to refinance with bad credit, but options may be limited. Working to improve your credit score before refinancing can lead to better terms and rates. https://www.bankrate.com/mortgages/how-does-refinancing-a-mortgage-work/

How to refinance your mortgage - Step 1: Set a clear financial goal - Step 2: Check your credit score and history - Step 3: Determine how much home ... https://www.experian.com/blogs/ask-experian/how-to-refinance-a-home-mortgage/

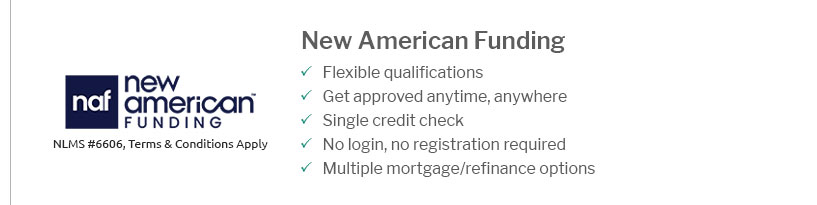

Shopping around is one of the best ways to score a lower interest rate on your new mortgage loan. Each lender has its own set of criteria for ... https://www.newamericanfunding.com/learning-center/homeowners/how-do-you-refinance-a-house/

Refinancing is a vehicle that lets you access the equity that is sitting in your home. Many people prefer this option when they need financing ...

|

|---|